self employment tax deferral calculator

The self-employment tax rate is 153. Ad Discover How to Manage Your Taxes If Youre Suddenly Self-Employed.

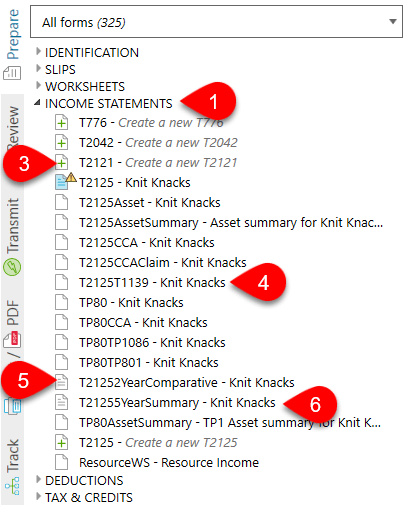

Self Employment Income T2125 Taxcycle

Benefit of Tax Deferral Calculator.

. Unfortunately self-employed individuals cant defer their entire Social Security tax over the eligible deferral period. This amount will not be included in self-employment taxes owed on the 2020 return. Ad Search For Info About Self employment tax deduction calculator.

COVID Tax Tip 2021-96 July 6 2021. When does the deferred amount need to be repaid. Enter your total employment wages and tips that you have been paid where Social Security taxes have been deducted.

Social Security tax deferral. Once you know how much of your net earnings are subject to tax its time to apply the 153. The rate consists of two parts.

How to report self-employment tax that was deferred in 2020 Agree these payments are related to the 2020 tax return and are not entered on the 2021 or 2022 return. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net. Tax deferral can help you grow your money faster since the value is not being reduced by annual income taxes each year.

Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. Self employment taxes are comprised of two parts. IRS Deferral of Self Employment Taxes Look at Section 21.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. However it will need to be repaid. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment.

Instead earnings and any untaxed contributions are taxed at ordinary. Maximum deferral of self-employment tax payments calculator. 1 Taxes are assessed and paid.

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of. SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. However if you are self-employed operate a farm or are a church employee.

This calculator provides an estimate of. Estimate and compare the future value difference between a taxable product and a tax-deferred product. Normally these taxes are withheld by your employer.

Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation. You dont need to pay self-employment tax on income under 400 The calculations provided should not be considered financial legal or tax advice. Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process.

Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Browse Get Results Instantly.

Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation. SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. Instead they can only defer half of their tax burden.

The maximum limit set for elective deferral is 19500 for 2020. Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today. In 2021 income up to 142800 is subject to.

Roughly 9235 of your self-employment earnings will be subject to self-employment tax. Browse Get Results Instantly. Discover Helpful Information and Resources on Taxes From AARP.

Ad Search For Info About Self employment tax deduction calculator. Learn More at AARP. Social Security and Medicare.

Under Section 2302 of the CARES Act a self-employed individual is able to defer 50 of the payment of Social Security Tax imposed on their net earnings from self. Use this calculator to estimate your self-employment taxes. This income is typically reported on schedule c.

Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under.

14 Tax Tips For The Self Employed Taxact Blog

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Irs Defers Employee Payroll Taxes Jones Day

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

How To Avoid Self Employment Tax Ways To Reduce It The Turbotax Blog

7 Easy Payroll Remittance Form Sample Payroll Payroll Taxes Form

What The Self Employed Tax Deferral Means Taxact Blog

/GettyImages-1126146268-c3dc871a24ae4d56857aa2e5dba217ec.jpg)

Tax Tips For The Individual Investor

Do You Need To Pay Income Tax Instalments Personal Tax Advisors

Resources Accounting Plus Financial Services

7 Rules For Wealth 6 Self Employment Tax Schemes

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

![]()

How To Save Taxes For The Self Employed In Canada Filing Taxes

Payroll Tax Deferral How Will It Affect You Experian

How To Save Taxes For The Self Employed In Canada Filing Taxes

Taxation Of Shareholder Loans Canadian Tax Lawyer Analysis

/cloudfront-us-east-1.images.arcpublishing.com/tgam/6X6BMLM5VNBAPBFZFTDIJ32LSM)

Six Creative Ways To Defer A Tax Bill For Years Or Decades The Globe And Mail